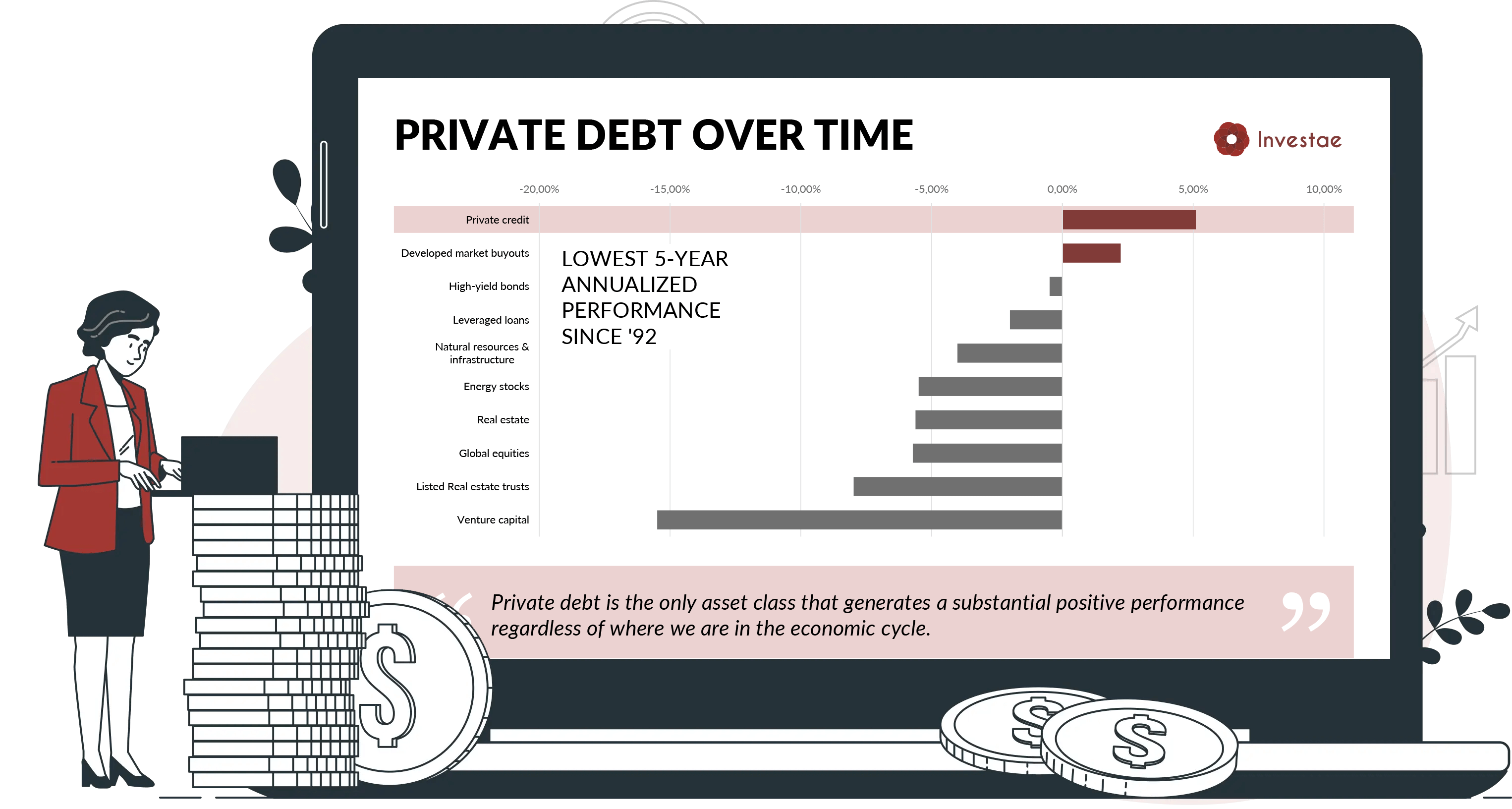

One of the main consequences of the 2008/2011 financial crisis is the reinforcement of the regulatory capital requirement for banks in the European market (Basel, 3 and 4).

A stricter regulatory environment has made it very expensive for banks to hold certain types of loans on their balance sheets. As a results, many SMEs have been left aside with no possibility to find financing. They are turning to private debt instruments. Private debt includes all forms of private lending, with or without ISIN.

Investors’ education is paramount

Primary focus on long-term relationship with investors and entrepreneurs

Uncorrelated asset allocation solutions

Focus on entrepreneurs with unique savoir-faire

Transparency of communication and process

Comprehension of investors’ expectations

Strict and thorough Due Diligence process

Fintech for capital raising